Charge to Mobile & PSMS Faq for O2 Customers

I’ve created this faq to address issues raised by O2 customers, usually on the community foum. Forum moderators will not allow me to refer to individual pages on this site within my posts and that has made it difficult to provide help for specific issues. The faq deals with many of the common questions, but is a work in progress. Suggestions for modification or improvement will be gratefully received!

In December 2019, Payforit was killed off by the networks. What does this mean? Not a lot! O2 customers are continuing to find unexpected charges on their bills. 3rd party charges will no longer be termed “Payorit”, but, depending on the precise mechanism, PSMS or Charge to Mobile.

New rules governing subscription services came into effect in November 2019. These mean that in signing up for a service you will have needed to take an affirmative action such as receiving a text containing a PIN and entering it on the signup page. It remains to be seen how effective this measure will be at reducing fraudulent charges, but initial indications are promising.

- I’m receiving ‘Charge to Mobile’ charges, or I’m being charged for Premium Texts. I know who is responsible for the charges. What should I do?

- I’m receiving ‘Charge to Mobile’ or PSMS charges, but I am unable to tell who is responsible for the charges, What should I do?

- I have received PSMS or “Charge to Mobile” charges. I didn’t subscribe to anything. How did this happen?

- Can I block “charge to mobile” charges and/or Reverse Premium Texts?

- My O2 PAYG balance is lower than it should be. How can I check why?

- Can O2 help me resolve a ‘Charge to Mobile’ or PSMS issue?

- Can O2 block ‘Charge to Mobile’ charges and/or Reverse Premium Texts from my account?

- I don’t believe that O2 pass my number to third parties. Can you show that this happens?

- I’ve sent a STOP text to stop a subscription, how do I get a refund?

- Why won’t O2 help me recover my money, surely they took it?

- The company that took my money has refused to refund. Is there anything else I can do?

- What is this ‘Payforit’ company?

- How is ‘Charge to Mobile’ supposed to work, and why is it so vulnerable to fraud.

- I’ve been told that the Phone-paid Services Authority might be able to help. Who are they and what do they do?

- What is the difference between ‘Charge to Mobile’ and Reverse Premium Charge texts.

- I’ve been caught out by a scam. Should I change my number?

- Is it true that O2 profit from these scams?

- I’m unhappy that O2 allowed this to happen. Is it worth moving to another network?

- I’ve sent a STOP text, but I’m still being charged. What can I do?

I’m receiving ‘Charge to Mobile’ charges, or I’m being charged for Premium Texts. I know who is responsible for the charges. What should I do?

The steps you ought to be taking are (with links to detailed instructions):

I’m receiving ‘Charge to Mobile’ charges, but I am unable to tell who is responsible for the charges, What should I do?

This is a problem which frequently occurs. Either a weekly amount (usually £3 or £4.50) is taken from your account with no explanation. It’s a good firstly to check your most recent transactions. Check your account for any charges related to 5 digit numbers

The usage statement will probably show one or more charges at weekly intervals.

Assuming that this is the case, these will be ‘Charge to Mobile’ or PSMS charges. You now need to try to find out what service you are subscribed to.

The first thing to check is that you are not barring the receipt of premium rate texts. There is little point in barring the receipt of these texts, as you are charged whether you receive them or not! If you have barred a number, thinking that the ‘Payforit’ texts were a scam, it’s worth sending a STOP ALL message to the number in question.

Check your messages,

Also check to see if you’ve placed a 5 digit number on your blocked /spam /reject list. If you have, unblock it and text the words STOP ALL to it.

If you can’t identify the originator of the texts, you could try this link:

http://mobilepaymentsupport.com

Input your mobile number and click send pin

You’ll receive a 4 digit number by text

Input that back on the page and click send

The next page will show details of any subscription your number is currently linked to including contact details and the 5 digit number to text the STOP ALL text.

Unfortunately this won’t work for all ‘services’, so even after this, you may still be unable to identify the ‘service’ you are signed up to.

If all else fails, you will need to raise the issue with O2. The regulator expects networks to render this minimal level of assistance, so if they are unhelpful, raise it as a formal complaint. Ask O2 to identify the “Level 1 Provider” responsible for your charges, a well as the individual service.

Once you have identified the source of the charges and sent a STOP ALL text, you can pursue a refund. Put the 5 digit number in to the number checker on the PSA website: PSA Website. Here you should find the phone number for the company which has taken your money. If the number checker doesn’t provide the details, call PSA on 0300 30 300 20 (Monday – Friday, 9.30am – 1230pm, excluding bank holidays) and ask them to help.

Once you have stopped the charges you can:

- Get a refund of charges already taken

- Complain to the Phone-paid Services Authority

- Protect yourself from further ‘charge to bill’ scams

I have received ‘Charge to Mobile’ charges. I didn’t subscribe to anything. How did this happen?

You need to be aware that while you are connected to the internet via mobile data, your number may be passed by O2 to third parties for charging purposes. The mechanism by which this happens is called MSISDN passthrough. This can’t happen while you are connected by WiFi. Once the third party has your number they can make ‘Charge to Mobile’ charges to your account, or send you reverse charges texts and, very unfairly in my opinion, it will be your job to argue for a refund!

I’m not going to insult the reader’s intelligence by saying that you must have ‘inadvertently’ subscribed. This probably happens occasionally but, if the rules are being followed, it should be very obvious if you are signing up to one of these services. More likely you’ve been signed up by a malicious script in a web page, or by malware on your phone. Whatever these companies may say, if you didn’t knowingly consent to these charges they are unlawful and you are entitled to a refund.

In common with all the networks, O2 make no effort to confirm that you have consented to these charges and refuse to help you recover your money. It’s rather like someone walking into your bank, armed with only your account number, demanding money from your account. They wouldn’t get very far with your bank, but O2 just hand over the money without asking for any evidence of consent.

So if you are receiving unauthorised 3rd party charges you will need to take action yourself.

Can I block ‘Payforit’ charges and/or Reverse Premium Texts?

You are strongly advised not to use settings on your phone to block these texts. You may well succeed in blocking the texts, but will not block the charges. There is nothing worse than being charged for a text you cannot see! O2 can put a “charge to mobile” bar on your phone, which will stop these charges. For some reason they won’t do this for business customers.

My PAYG balance is lower than it should be. How can I check why?

If you are unable to access details of the charges, you will need to contact O2 to ask for details.

Can O2 help me resolve a ‘Charge to Mobile’ issue?

In general, the answer to this is no. If you are having trouble identifying the ‘service’ which is taking your money, they are supposed to help you with identifying who has taken your money. That is the only help they are currently required to give. It is up to you to stop the charges and get a refund. Many consumers find this difficult to understand. I often hear ‘O2 gave them my money, surely they should help me get it back’. I sympathise and agree that this should be the situation, but it isn’t, so you need to deal with it yourself.

O2 are not an FCA regulated payment processor. Regulated payment processors have to comply with the Payment Service Directives which require them to assist in the case of disputed payments and to take measures to prevent fraud. None of these apply to O2 who are allowed to operate as payment processors without FCA regulation

Your first step should be to contact the “Third party” which has taken your money. Tell them that you never consented to the charges and that you want to see their evidence that you did. Insist on a FULL refund and don’t accept anything less. Make sure you obtain evidence that you have discussed you dispute with the third party company.

If you are not satisfied with the result of your initial contact with the company, you can then escalate your complaint to O2 and they OUGHT to help (but they rarely do!)

O2 will probably be quite resistant to this, so you may need to raise the issue as a formal complaint.

The reality is that O2 are unlikely to help you resolve your dispute. In a few cases they may refund charges as a “goodwill” gesture, but in most cases you will be “on your own” in fighting to get a reund.

Can O2 block ‘Charge to Bill charges and/or Reverse Premium Texts from my account?

This has been a cause of much confusion in the past. O2 do offer a facilty to ‘bar all direct to bill debits’ which should be effective against ‘Charge to Mobile’ scams. The only problem is that some O2 staff do not seem to be well versed in the various account bars which can be applied.

It is best to contact Customer Services to get this bar applied, and try to make sure that the customer service agent understands the difference between a ‘Premium Rate bar’ and a ‘Charge to Mobile bar’.

The situation as regards blocking ‘Charge to Mobile’ and PSMS charges on other networks is discussed here.

I don’t believe that O2 pass my number to third parties. Can you show that this happens?

Absolutely.

Here’s a test you can try.

As an example browse to jamster.co.uk using a WiFi connection. Go to html5 games and click on Flappy Bird.. Click the red button and you will get this screen.

WiFi Connection

Note that it asks you for your phone number. This is because the company have no way of knowing your phone number. They can’t get it from your phone as your web browser won’t have permissions to this information.

Now use a mobile data connection (3G or 4G) and repeat the process.

4G Connection

Note that in this case it gives you the opportunity to subscribe WITHOUT asking for your phone number. This is because your phone number has been supplied by O2 via ‘Payforit’.

All this is perfectly normal expected behaviour and is not indicative of a scam. It’s just that many consumers don’t realise that their phone number can be passed in this way.

Unless the user is very careless with security and App permissions, there are only 3 ways a company can get your number:

1. You type it in and deliberately give it to them.

2. Your network provider passes it to them.

3. They obtain it from some other third party as a result of you having supplied it quite legitimately for contact purposes.

The problem is that O2 have no way of knowing whether a charge is legitimate and make no checks. It’s rather like having someone walk in to your bank, knowing your account number, and saying they have your authority to take out money from your account. The bank would insist on proof, but O2 just pay out the money. Of course, your phone number is far less secure than your bank account number as you need to give it to people to be able to contact you.

I’ve sent a STOP text to stop a subscription, how do I get a refund?

You should approach the company that took your money for a refund. Tell them that you never knowingly subscribed, and that you never used the service they provided. Further advice on this process is here.

Often these companies will refund without too much difficulty, particularly if the amount involved is small. When the amount involved is larger (because the ‘subscription’ was not spotted at an early stage) they can be more difficult. There is advice on how to deal with this situation here.

The most important thing is to be persistent. You will find many success stories on the pages of this site.

Why won’t O2 help me recover my money, surely they took it?

You would think they would wouldn’t you? I’m afraid all the networks, including O2 refuse to intervene in disputes between their customers and ‘Chrge to Mobile’ scammers. So you really do have to do it yourself. It isn’t fair and it isn’t moral, but that’s how it is!

If you have difficulty dealing with the company which took your money, the rules say that O2 should step in to help. Unfortunately, in common with the other networks, O2 currently ignores this obligation. You could take action to force them to meet their obligations but this will be time consuming and is unlikely to get you your money back. Legal action against the scamming company will usuallyoften be more effective. However, if dealing with one of the prolific offenders like Lasevia Ltd, Ferdamia Ltd and SB7 Mobile Ltd, you may be able to use the Small Claims procedure to recover your money from O2, citing their negligence in not stopping the fraud that they were clearly aware of.

The company that took my money has refused to refund. Is there anything else I can do?

There is no formal disputes /refunds mechanism for these charges’. You are supposed to be able to “escalate” your complaint to your network for them to investigate and come to a decision. However, at the time of writing, the networks are completely abrogating this responsibility. Ultimately, for companies based in the UK , the best approach is to use the small claims court. Be calm and be fair. Send a ‘Letter before Action’ to the company giving them a reasonable period to refund. If they fail to do so, you will need to consider taking action through Moneyclaim Online. We advise that you contact us to discuss your case before doing this. In most cases it will be worth pursuing your case, This will cost about £25 which will be added to your claim. In some cases a court claim might not be the way forward

- The company is likely to be insolvent and unable to pay your claim

- The company is based overseas

Most companies pay up when faced with a Letter before Action. They nearly all pay up when faced with the court documents. Few cases get beyond this stage, although of course we can’t promise that your case won’t be the exception.

You need to consider carefully the company’s response to your letter before action. If they have provided a detailed response which “proves” you consented to the charges, you will need detailed help to contest this.

Companies often claim to have ‘proof’ that you ‘consented’ to the charges. This is nonsense, all they have is a weblog which shows that certain links were clicked on your phone. There is plenty of evidence that this can happen as a result of malicious code in webpages, or malware on a users phone. It is not evidence of consent.

It is also worth asking the company whether they have any evidence that you actually used the service you were charged for.

Full information, including a sample Letter before Action is here.

What is this ‘Payforit’ company?

Payforit was not a company. It was the name given to a payment mechanism designed and operated by O2, Vodafone, Three and EE. Although there was a Payforit website, there was no method of contact, because they never really existed. So when networks blamed ‘Payforit’ they were really blaming themselves!

How is ‘Payforit’ supposed to work, and why is it so vulnerable to fraud.

Payforit was a mechanism designed to allow the purchase of goods or services to be charged directly to your phone bill. With PAYG providers the charges were taken from your airtime balance.

When you browse the internet using mobile data, the payforit mechanism allowed your phone number to be supplied directly to third parties and used for charging purposes. The rules governing this were quite strict and intended to prevent fraud.

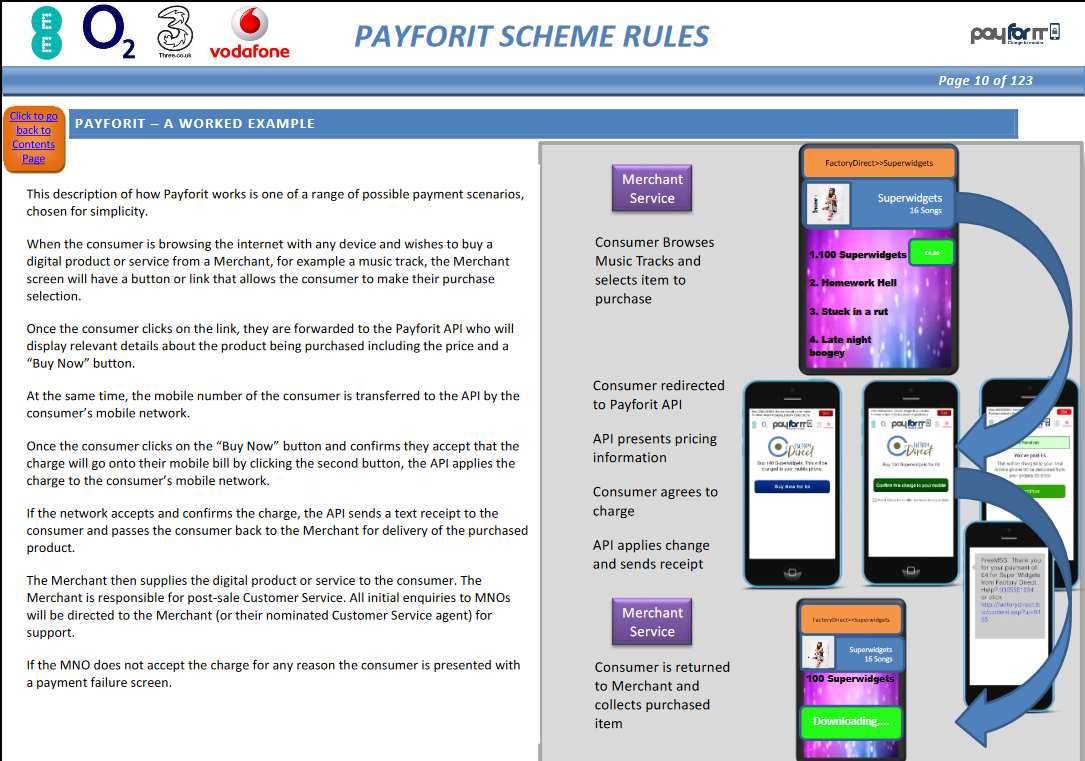

The illustration below shows how it should have worked:

The problem was that fraudsters found ways of circumventing the safeguards, either using javascript exploits on web pages, or with malicious code in mobile Apps (This was a problem particularly with Android phones). These exploits were capable of silently signing consumers up for subscription services without their knowledge or consent. It could therefore appear, when investigated, that the consumer had subscribed to a service when in fact the signup was completed by malicious code without their knowledge.

Although Payforit has now been abandoned, all the processes remain the same, but without the “Payforit” branding.

The chief vulnerability is that the consumer’s phone number is passed to the ‘third party’ just by clicking a couple of links. Malicious software can disguise these clicks, or even emulate them, and it is apparent that this is why so many consumers are receiving unexpected ‘Payforit’ deductions. Since November 2019, additional authorisation hzs been required for subscriptions. Normally, but not always, this involves a PIN being sent to the phone by text which then has to be entered in to the service website.

The Phone-paid Services Authority(PSA) regulates the industry.

I’ve been told that the Phone-paid Services Authority might be able to help. Who are they and what do they do?

The Phone-paid Services Authority(PSA) is the regulator for Premium Rate Services, including ‘Payforit’. It is important to understand their role. They are not an ombudsman. They will not intervene in individual disputes between consumers and companies.

Sometimes networks will tell you to ‘escalate’ your complaint to PSA, or say ‘PSA will sort it out for you’. This is misleading. PSA will advise, but will not intervene. Sometimes, after months of investigation, PSA will order refunds after an investigation of a company, but this a byproduct of their investigation. If you want your money back quickly you need to take action yourself.

Despite this, ‘Charge to Mobile’ or PSMS scams should be reported to the PSA. If enough complaints are received, the PSA will investigate. The PSA publish a Code of Practice, with which all operators are expected to comply. Among other requirements the Code insists that operators should have robust consent before charging.

The PSA is funded by the industry it regulates, and that is a serious problem.

Take a look at their Facebook reviews.

They are not a great advertisement for self regulation. Nevertheless, if you’ve been scammed, please report the matter to PSA. Make sure they give you a case number and use this to copy PSA in to all communications between you and the company that took your money. Reporting to PSa also means that your case will be recorded in the official figures. These figures are important in highlighting the scale ofhis type of fraud.

Complaining to the Phone-paid Services Authority.

More information about the Phone-paid Services Authority.

What is the difference between ‘Payforit’ and Reverse Premium Charge texts.

Reverse Premium Charge texts used to be the method of choice for scammers, as none of the networks seems to be able to stop them.

A couple of years ago it became mandatory for subscription services to charge via ‘Payforit’, as this was supposed to be more secure.

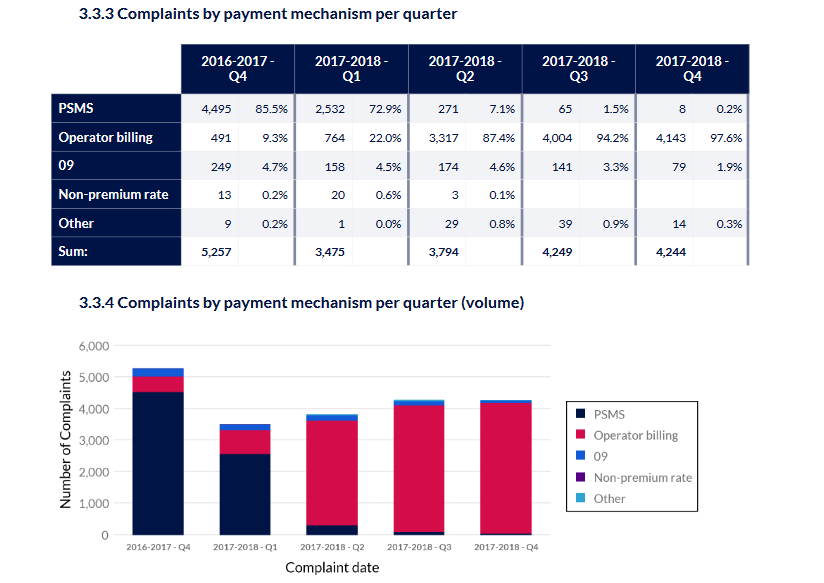

The scammers thennow turned their attention to ‘Payforit’ as will be seen from the following graph from the Phone-paid Services Authority.

After the end of 2016, Premium Text (PSMS) complaints all but disappeared whilst Operator billing (Payforit) complaints saw a massive rise with Payforit becoming the scammers weapon of choice.

With the death of Payforit we have seen a new rise in PSMS scams, and it will be interesting to see the figures for 2020 when available.

I’ve been caught out by a ‘Charge to Mobile” or PSMS scam. Should I change my number?

Some people may advise you to change your phone number after receiving scam charges. If you have successfully stopped the charges this is unnecessary. Your new number is no more or less likely to be affected by another scam than your old number.

Unfortunately, if you are determined to have no dealings with the company that scammed you, this may be only way of stopping the charges. However we have never heard of anyone being unable to stop the charges, either by sending the STOP text or by calling the service’s helpline.

In summary we wouldn’t recommend changing your number. For most people this would be very inconvenient and it doesn’t reduce the risk of another scam.

Is it true that O2 profit from these scams?

It’s impossible to say with certainty, but let’s look at the evidence:

The networks including O2 are normally reluctant to make any comment concerning this. No comment is most certainly not the same thing as a denial. However, in 2016, Vodafone broke ranks and admitted that it received ‘a small margin’.

I find it rather unlikely that Vodafone are alone in making a profit from these scams.

When similar ‘charge to bill’ arrangements have been subjected to scrutiny elsewhere it has been shown that the networks have profited from them.

O2 will incur costs in handling these charges and dealing with queries related to them. They are not a charity, and I would at least expect them to be covering their costs. Subsidising these scams would, I think, be a even worse accusation than profiting from them!

I remain of the view that it is overwhelmingly probable that all of the networks, including O2 profit from ‘Payforit’. They are not charities after all.

I’m unhappy that O2 allowed this to happen. Is it worth moving to another network?

The networks approach to ‘Payforit’ scams varies. Let’s start by making it clear that moving to another network will not stop any existing charges. The charges relate to your number and will follow you if you move.

The current situation is:

O2, EE and Vodafone all offer a ‘charge to bill’ bar which will stop ‘Payforit’ charges. Three and GiffGaff do not. If you have up to date information about other networks please get in touch.

All networks apart for Three now require a two stage authorisation with PIN for all subscription services. The quality of enforcement of this varies, but there has been a big reduction in complaint since November 2019 when this came in to effect.

So, as things stand today (3rd May 2020, we would have to recommend EE as having the best package to combat these scams. However, it has not always been so. In 2017, EE would have been the last provider we would have recommended as they had a very high incidence of scams.

The situation is likely to change again later this year, after the PSA complete a consultation on the rules for subscription services. It seems likely that they will, at least, require other networks to implement the same measures as EE. There are many good reasons for leaving or joining a network, and I would not be unduly swayed by their attitude in this area. More important is to keep careful eye on your account and deal with any ‘Payforit’ scam quickly!

I’ve sent a STOP text, but I’m still being charged. What can I do?

If you’ve correctly sent a STOP text you will normally receive a reply confirming that the subscription has been stopped. If you received this, and the charge was made shortly after you sent the STOP message, if could be that the charge was initiated before the STOP was sent.

If you didn’t receive the text confirming that the service has been stopped, check that the STOP message has been sent to the correct number. This should be the 5 digit number referred to in the subscription text. This may not be the same number as the text was sent from, so be careful.

If you sent the STOP text to the correct number, but didn’t receive the confirmation text, it is probably best to ring the company on the number they provided in their sign up text.

In the unlikely event that you continue to be charged after sending a STOP text, this is contrary to the Phone-paid Services Authority Code of Practice. Complain, both to O2 and to the PSA. Keep evidence on your phone of the text messages you have sent and of any messages received. ‘Services’ can be fined heavily for failing to comply with an instruction to STOP.