Step 3 – Make a complaint to the Phone-paid Services Authority(PSA)

If you have been signed up without consent to one of these premium rate services it really is important that you report it.

You should complain even if you have received a full refund. It is unlawful to charge without consent and providing a refund doesn’t make it right!

The PSA is not an ombudsman or a disputes resolution service, so don’t expect them to intervene directly in your case. They are regulator, and will investigate if they receive a large number of complaints about a particular company.

In truth, PSA are generally quite ineffective, but they do compile statistics of complaints and these scams are massively under-reported. Make sure yours is included!

It it contrary to the PSA Code of Conduct to sign people up for these services without their consent, and these companies need to be shut down quickly. Your complaint may help others.

Before complaining you need to know the following.

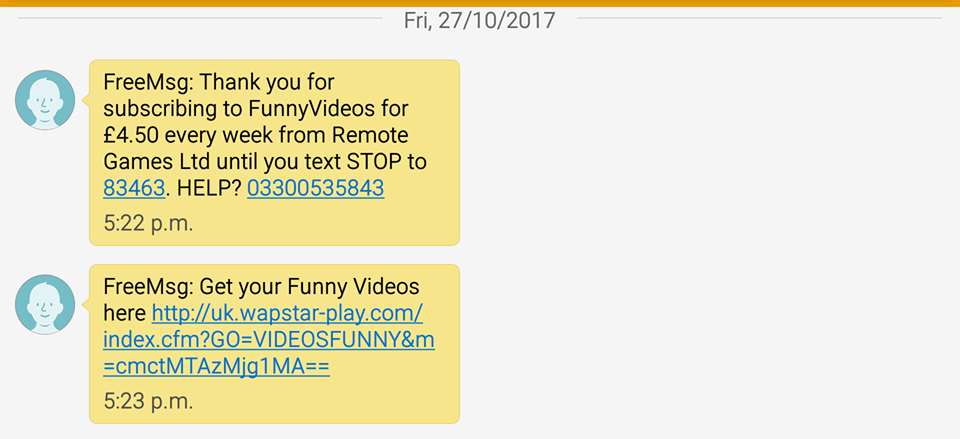

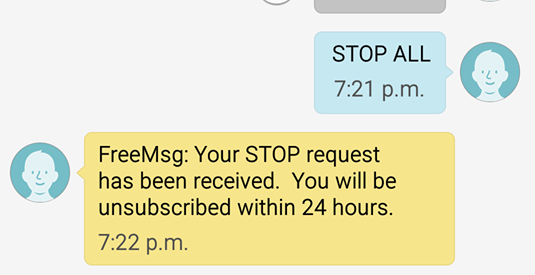

- The premium rate service the number relates to. This can be retrieved either from your text message confirmation or your phone bill.

- The name of the company providing the premium rate service.

- Your personal details, such as your name, address and contact details.

- The name of your phone or mobile network.

You do not need to attach a copy of your phone bill to make a complaint to PSA.

To make a complaint:

Go to the number checker on the PSA website: https://psauthority.org.uk/about-us/number-checker.

Put in the shortcode you are complaining about and click ‘Check it!’. You may need to complete a Captcha challenge in order to proceed to the next stage.

The next screen shows details of the company(s) responsible for the shortcode. Towards the bottom of the page there is ‘If you are unsatisfied with the outcome from the service provider, please get in touch with us here.’. Click on ‘here’ and you will be taken to the complaint form.

The more information you can include in your complaint, the easier it will be for PSA to take action.

It is particularly important to include correspondence which shows that you have asked for proof of consent and that this has not been provided. General comments to the effect that you must have clicked a series of links is NOT PROOF.

If you find the online process too cumbersome you can complain by ‘phone on 0300 30 300 20 (Monday – Friday, 9.30am – 5pm, excluding bank holidays). This is charged as a normal landline call.

You can also contact them via Facebook messenger.

If you still have problems making a complaint, contact me through this site for help.

You should receive a case number from PSA. Make sure that you keep them informed of any further dealings with the company which took your money, and the progress of any legal proceedings you take through the Small Claims procedure.

After complaining to PSA you need to consider how to protect yourself from these scams in the future.

Step 4 – Protect yourself