In May 2018 there have been a large number of complaints about Nuyoo fitness. This is a service operated by a company called SB7 Mobile, which has has previously been fined for breaking the PSA Code of practice. The previous adjudication can be seen here.

UPDATE: This scam is continuing in to August 2018. Here are a few recent complaints, which could be referred to in a letter before action to show that, in all likelihood, Nuyoo is a signing up consumers without consent,

UPDATE: October 2019

There have been few recent complaints about Nuyoo and it currently appears to be impossible to sign up for a new Phone-paid subscriptions. They appear to have “gone legit” and now allow you to set up subscriptions via more conventional methods. This doesnt mean that eisting subscriptions have been cancelled though, and some consumers have racked up charges in three figures over the months!

They operate through a Level 1 provider called Tap2Bill who are responsible for the 83463 shortcode which is associated with quite a few of these scams.

It also seems that a large number of affected consumers are with the Three network, so I wonder whether there may be a network specific problem here.

Please leave a review of SB7 Mobile Ltd on Trustpilot. https://uk.trustpilot.com/review/sb7mobile.com

Advice if you’ve been affected by the Nuyoo scam.

Unfortunately, the way that this works is that you have to contact SB7 and get them to stop the subscription. You should also ask for a full refund of any money they have taken. You are entitled, under Section 45(3) of the Consumer Rights Act 2015 to insist that this refund is made back to the account from which it was taken. Under section 45(4) of the same act, any refund needs to be made within 14 days of it being offered and accepted.

If SB7 claim you consented to their charges, ask them for:

- Screenshots of the subscription workflow where you were alleged to have signed up for this service.

- A description of what the service you are supposed to have subscribed to provides? Is this a newsletter, access to a web portal?

- Any evidence that after supposedly signing up for the service, you actually used it

- The complete web server log of the subscription, including the User Agent strings containing all device details (browser, device type, device IP address) together with dates and times.

- If the subscription started after 11th May 2019 and your network is O2 or GiffGaff,, auditable proof of the additional authentication used (as required to comply with O2/GiffGaff rules)

- Full company details of the company operating the service, country of registration, full name of company, company number and registered company address.

- Details of the Accredited Payment Intermediary(API) which handled the payment

- Details of the company’s disputes procedure, including any ADR scheme you can refer the matter to if they fail to provide a full refund.

Remember that under UK law, where the existence of a contract is disputed, the burden of proof rests with the vendor to provide evidence of that contract. If they can’t provide that proof, the charges are unlawful and should be refunded IN FULL.

In the unlikely event that you are provided with proof, refer back to this website for advice on refuting it.

If SB7do not co-operate or do not refund in full, you can then revert to your own network, and ask them to take action under the Mobile Operators Code Of Practice for the management and operation of PFI (Payforit). O2, EE, Three and Vodafone also have their own procedures for handling ‘Payforit’ and these are linked on this page which gives more detailed advice on how to proceed if you are refused a full refund.

Ultimately if a full refund is refused I have evidence that these companies will pay out when faced with the possibility of a claim in the small claims court. Ultimately they have to prove that you knowingly consented to the payments or make a full refund. Look here for advice on how to use the Small Claims procedure to force them to refund.

You should also complain to the Phone-paid Services Authority about the unauthorised charges. The regulator will not handle individual cases, but will take action if specific companies generate a disproportionate number of complaints. SB7 have been the subject of a number of other recent complaints.

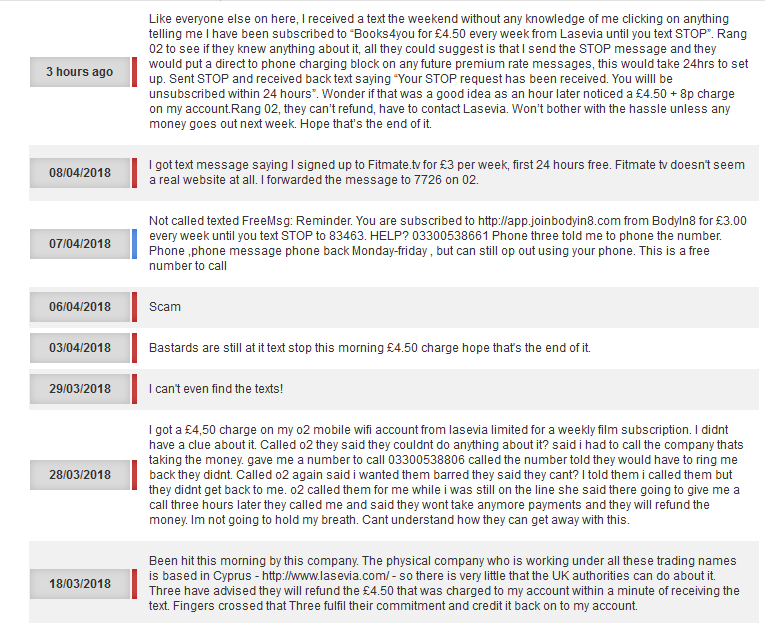

Sample reports of the Nuyoo ‘Payforit’ scam

Had the same. Absolutely astonishing that my phone provider @VodafoneUK just allow it to happen either. It’s obvious companies like @nuyoo_fitness are scammers yet still just let it go.

— Scott (@scottlley) May 16, 2018

I sat waiting for someone to answer my call in a queue for 20 minutes and then the call just hung up. It said it’d go to an automated call back service but nothing. I have also emailed you. I have not opted into this service, authorised my billing or for you to contact me #scam

— Karen Rait (@k4r3n5) April 16, 2018

You say you use a two step double opt-in process, so why are so many people so surprised to find out they have been subscribed to your service? It’s because you are using a #payforitscam to snare new customers. #nuyoo #nuyooscam

— Andrew whitehead (@wjydna) May 11, 2018

[1/2] Hi Manuel, you can’t put a spending block on your account to prevent payforit charges or short codes being applied. If you’ve been affected by something like this you’ll need to contact the company directly to get a…

— ThreeUKSupport (@ThreeUKSupport) May 12, 2018

@PSAuthorityUK @nuyoo_fitness did not sign up for this and have been added for no reason, why is this, very dodgy practice

— Matt Palmer (@mattpalmersport) May 16, 2018

Scam artists

— Umit (@Umit69466058) May 16, 2018

@nuyoo_fitness why are you charging me for you services.I never signed up for anything.

— Martin F. (@DeadGull) May 18, 2018

@PSAuthorityUK@nuyoo_fitness have charged me 4 times now for something I have never heard of nor signed up to. £3 on 4 occasions over a month have been added to my phonebill for 4 texts I have received without my consent

— C_Tandy (@C_Donbie) May 9, 2018

#nuyoo @nuyoo_fitness I have never heard of you or sought to look for your services. Yet today I get a text message to tell me that I am being scammed £3 a week for your services. Which I never agreed to or was never aware of! I hope my service provider @ThreeUK stops this shit

— michael spalding (@mikespalding) April 21, 2018

I had the same .3 network will do shit about it.3 customer service guy was shouting at me over the phone that i had to accept these charges but i never https://t.co/pYSpYyhzV3 another text https://t.co/uQFppEOgHK pissed off

— Norbert Kwiecien (@noreksko) May 10, 2018

@ThreeUK just been signed up to a service by @nuyoo_fitness that I neither wanted or asked for. What should I do? Should i report to @Ofcom?

— Al Smith (@setantii_) May 7, 2018

Shady business practices have a big impact on your reputation! #nuyoo need to bin their #payforitscam and refund people who have been charged via their mobile phone bill for a service they didn’t sign up for. #nuyooscam #Health #fitness #WednesdayWisdom

— Andrew whitehead (@wjydna) May 2, 2018

I’m glad @ThreeUK and their customer service has made up for the lack of customer service shown by @nuyoo_fitness who I’ve never heard of before

— Nathan Richards (@NateDayToDay) May 8, 2018

when ate you fraudsters going to be refunding the money you have been stealing from me since January??

— Howard Hughes (@beatboxking8877) May 10, 2018

@ThreeUKSupport just been hit by this “pay for it” scam.. I have absolutely no idea where it came from, no confirmation screen for a purchase or anything! I want this crap off my bill

— DankStain (@dank_stain) May 13, 2018

@nuyoo_fitness Thank you for admitting what we all knew. @FRAUD @CANCELMYACCOUNT@REFUNDME pic.twitter.com/oz9R4v2rUS

— Conor Charlton (@RanchoControl) May 4, 2018

@PSAuthorityUK hello along with many others I have had £3 per week taken out of my mobile account from a company called @nuyoo_fitness without my permission. Any chance you can investigate?

— Paul Rogers (@Paulrogers65) March 22, 2018

75£ illegally charged by @nuyoo. Hey @ThreeUKsupport, what is Payforit “service”? What kind of service is that? How can you charge customer without their consent? You don’t even bother to inform your customers either. This is clearly an organised scam and your part of it #scam

— Adrien Ortist (@AdrienOrtist) April 16, 2018

I have just received the text message for this today. I am also on o2. Absolutely disgusting!

— Collum Bill (@Collum_Bill) April 20, 2018

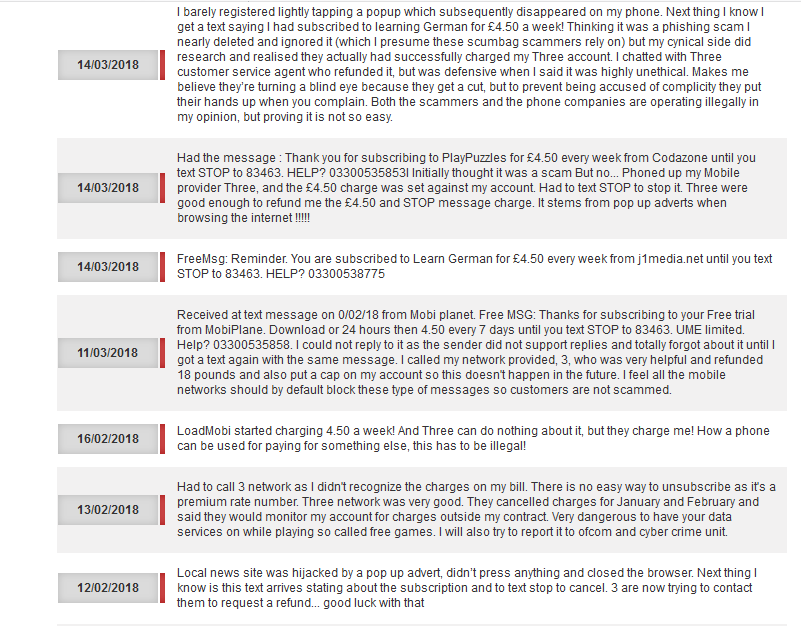

On GiffGaff Forum

Nuyoo spam text

by aaronmc97 in Help & Support

12-04-2018 00:29

Hi, I’ve been hit with a spam message, said ive apparently joined “Nuyoo.co” and received a text telling me that I’ll pay £3 a week or I can text STOP to a number, I texted STOP and it wouldn’t go…

Show results in replies (3)

oscarmr has a question about Hello I am receiving …

by oscarmr in Help & Support

10-04-2018 20:32

…and I don’t even understand how it came to my phone. They are charging every time they send me a message at least 3 pounds. I have cancel premium calls and I am going to try to block the number with…

Show results in replies (5)

drpetermezes has a question about I recieved scam …

by drpetermezes in Help & Support

02-04-2018 22:21

I recieved the following text: FreeMsg: U have joined to get fit @ http://nuyoo.co for £3.00 a week. Ur first 24 hours are free. To cancel text stop to 83463. Help? 03300535869″ Please advise

spam text

by pharmaroxxx in Help & Support

24-03-2018 02:27

hi, i have received a text message from an online gym company (nuyoo.com) which wants to charge me £3 a week to recieve text messages from them. it says i have already signed up but i haven’t. what…

Hide results in replies

Been charged £3 for unknown text

by missbarron90 in Help & Support

12-01-2018 17:48

Hello i received a text message the other day from 3009007 the text said paid for it charge and it took £3 off my credit i have no idea what this is and have blocked the number has anyone else had…

Show results in replies (1)

Stop Payforit Fraud

Stop Payforit Fraud